- Finding optimal portfolioin excel solver function full#

- Finding optimal portfolioin excel solver function crack#

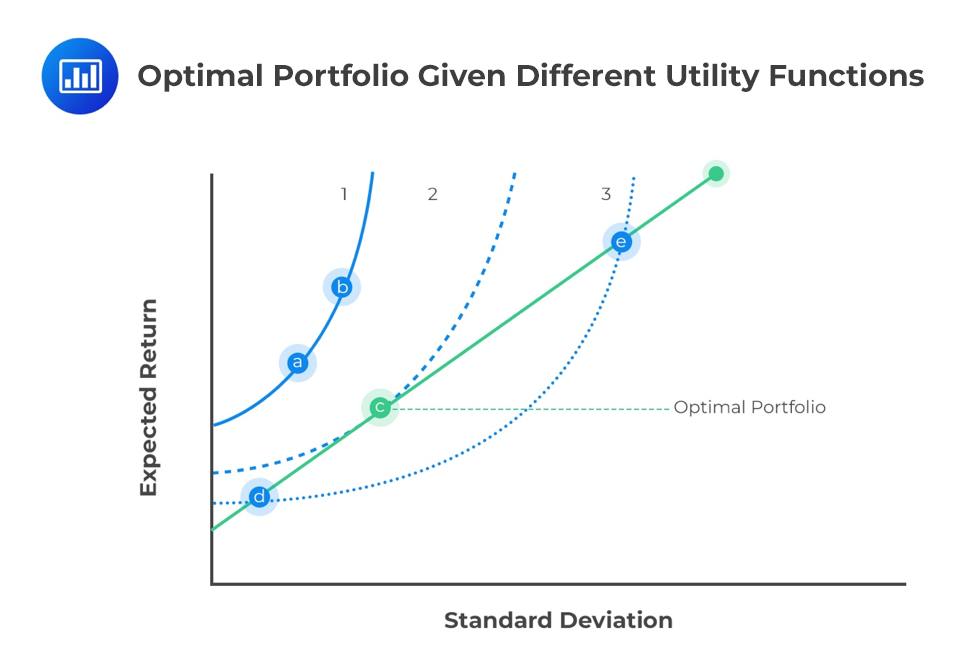

A more detailed and step by step implementation can be viewed at the link that follows. For most markets we also check the non-negative option to ensure no short sales are allowed by the model. Given the usage of duration and convexity, this is a non-linear problem. From an Asset Liability point of view, we can also specify a target duration or convexity threshold that needs to be matched or exceeded. Typical limits involve risk, duration, position size, liquidity, concentration and capital allocation. The portfolio score becomes the objective function.

The sum represents the score for the portfolio. The score is then multiplied by the exposure (size of position) for each bond and summed across the entire allocation band (vector or row). Duration or interest rate sensitivity serves as a proxy for risk. This can be handled by creating a unit of yield for a unit of duration (divide YTM by duration) score for each bond. Fixed Income Portfolio Optimization using EXCEL Solverįor a given portfolio of bonds, the general challenge is optimizing the duration yield trade off. We hope that these design patterns will give you a leg up the next time you come across a challenging optimization question. Here is a set of problems and applications we have solved in the past with Excel solver. It is a sub-optimal approach but in the absence of a formal solution, it can help us get close enough to the optimal solution. With larger more complex problems sometimes it makes sense to break the problem into smaller sub problems, solve them in sequence and then plug the solution together. You may have to turn the problem around on its head with the objective function becoming a constraint and a constraint becoming an objective function. The resolution to this setback requires a visit back to the drawing board to figure out a structure that Solver can actually solve. It’s not the end of the world and if you are limited to the MS Excel version of Solver, quite common. Sometimes the original configuration turns out to be unsolvable. If the model is defined and set up correctly solver can solve for it.

Finding optimal portfolioin excel solver function full#

These could be the size of a single position relative to the size of the full portfolio, non-negative exposures (no short selling allowed), additional risk metrics (such as value at risk or VaR for short), liquidity and concentrations limits (not more than a certain amount of daily traded volume) and capital allocation limits (could be a function of value at risk above, regulatory or compliance constraints).Ī large part of the work for a solver challenge is figuring out the right objective function and the right set of constraints. In addition to the objective function, there are additional constraints that the solution needs to comply with.

The objective function is what Solver solves for. The objective function can be maximized or minimized. This could be risk, return, a sum or a difference. We begin by identifying an objective function. Solver application in portfolio management follows a standard framework.

Finding optimal portfolioin excel solver function crack#

We walk through these problems at a high level to give you a sense of patterns we can use with Excel Solver so that the next time you see a challenge, you can use an existing Solver optimization design to crack it. Each problem and challenge required a specific formulation and approach. Over the years we have used Excel Solver across a range of portfolio applications. Portfolio analysis applications with Excel Solver Challenges include applications from trading fixed income bonds, equities, options and index matching portfolios. A review of portfolio applications with EXCEL Solver including portfolio construction, allocation and optimization challenges.

0 kommentar(er)

0 kommentar(er)